Net Present Value – Business Energy Savings over Time

Nov 05 2020

In commercial buildings, there are always repairs and maintenance to be done, from the biggest manufacturer to the smallest retail shop. Municipal buildings can be very similar in usage, although quite different in how they make decisions on capital improvements.

Investment in a building is no different than a home, but the scale is much larger and complex, especially in terms of energy efficiency. This is due to the heavy usage and hours of commercial buildings vs residential. To put this in perspective, a typical high bay fixture uses more energy than the lighting of an entire home – and the hours are much greater.

For the past 10 years, I have run a business focused on helping businesses reduce their energy usage. We have several key client segments that are really interesting, since they are typically longer term in thinking and are able to think about longer term investments. These building types include fire stations, libraries, and McDonalds – about as safe as you can have in terms of a future need for that building in the future.

Our commercial customers typically want to see a “payback” or ROI of 2 years or less. These terms are used interchangeably, although they have a wildly different meaning in finance. As of late, I have been exploring the net present value of energy efficiency investment to help our clients look longer term.

Payback for Energy Savings

Payback can be the easiest to understand, and is simply the energy savings per year divided by the investment. If the investment is $2,000 and the savings is $1000, the payback on an energy efficiency investment is 2 years.

Our business is located in Illinois, and we are fortunate to have an incredible utility incentive system. For that reason, we can often find greater impact projects that normally would have a 8-10 year payback, and bring it back within a clients expectations of within 2 years. Each client is different – so we always ask what they consider a good investment payback range.

Payback is impacted by the cost of electricity, the hours of usage, and the difference between the wattage usage of the old product compared to the new product, measured in kWh.

Return on Investment for Energy Savings

This is a different term, but often gets used interchangeably. Another way to look at energy efficiency investment is to think, “What else would the business or community do with this money?”

In the same $2,000 investment above with $1000 of annual savings, that would be a 50% Return on Investment. I often ask business owners – “What else could you do with your money that would return 50% a year as long as you operate this building?” I mean seriously – if that is an amazing return in any portfolio and is really right under our noses all the time.

Sure – you can get too focused on this and find diminishing returns. But I always feel bad when I return to a business in two years after they passed on a great project, only to later do it with higher costs. They would have already had it paid off, and usually regret it.

Even a $5,000 investment that returned $1000 of annual savings would bring a 20% return on investment. An, in fact, the original $5,000 likely improves the value of the building. And again, I ask owners if you were to invest $5,000 into the stock market and it returned 20% a year for the next 10 years, how would you feel about that? Why do you evaluate this investment differently than others?

Net Present Value for Energy Savings

When you look at projects that are more complex, like Solar PV, Heating and Ventilation improvements, or advanced sensor and control systems, you likely need to go past 2 years to evaluate a return on investment or ROI. For example, when moving into a new building for a warehouse, a business often will have a 10 lease. Investments in HVAC equipment or lighting systems can make sense with a short term return, but they often lead to longer term savings with advanced considerations. Net present value is a tool that helps people consider this.

Net present value is not just adding up 10 years of savings, as would be the logical way to do it. And doing that is not necessarily the wrong way to to do it, but it is a stagnant way of looking at savings in the future. NPV is a way to account for what else you would do with that money, or better said, discounting the future savings to account for inflation.

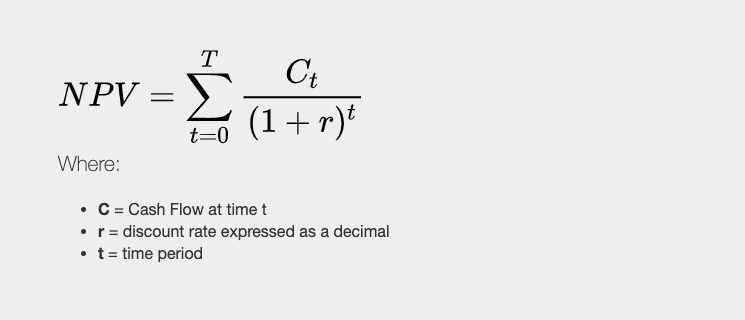

The exact formula is as follows, and basically any investment smaller than the net present value of a project checks the box of cost effectiveness. It is confusing, and there will not be a test at the end of this. However, it basically means that if a business is saving $500 per year in an investment, you would discount each additional year a slightly greater amount to reflect the lower value of today.

Fortunately, the formula in excel is much easier. NPV =(3.75%, savings first year, savings second year, savings third year, and so on) with 3.75 as the discount rate and then the summary of the years of savings. In excel, it calculates the t or time period for you based on the number of years of savings in your list of years.

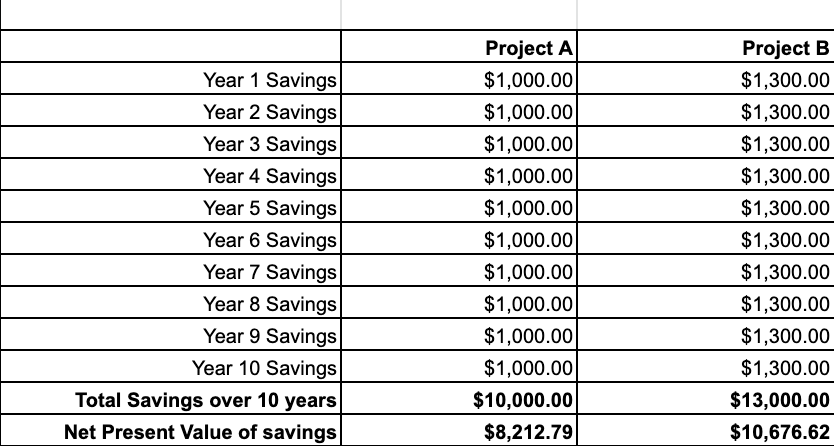

Below is an example, where the savings are $1,000 per year on an efficiency project, and the time is a 10 year lease. You can image the investment in a high efficiency water heater, HVAC system, or even advanced lighting control system that monitors and reports your energy usage.

The net present value on System A is $8,212 and the NPV on System B is $10,676. Let’s imagine a scenario where System A investment cost is $10,000 and System B is $10,500. Project A is not worth doing if the building will only be occupied for 10 years, as the long term savings are less than the cost today. However, System B has additional savings – maybe the light have a control system and claim an additional 30% saving each year, and the investment is less than the net present value of the savings.

Discount Rate for Energy Efficiency

Now the devil is in the details of this formula, especially in terms of the interest rate chosen. I have 3.75% for mine, as that is the current rate loaned by the US government to businesses in the EIDL loan. It is also the interest rate of our current line of credit with our bank. The higher the interest rate, the more conservative you will find your net present value – it is counterintuitive but a lower interest rate will make the savings bigger.

This tool can of course be used to manipulate data to make a project more appealing, like any finance tool. But it is still worth understanding and using with projects.

Future Energy Cost Inflation

Another thing not considered in this formula is the rising costs of future energy rates. Often, those increases in energy costs will offset the discounted future savings – so if you assume 4% increase in energy rates each year and a discount rate of 3.75% – you would actually see a higher NPV than the summary of the savings. However, I tend to leave that off as it can get go down a rabbit hole of making a project fit into your world view. I have seen many projects fall apart because people cannot agree on an inflation cost of energy. In my scenario, it is conservative and hard to argue against, as long as you agree on the time period being evaluated and the savings calculated.

Adding this can help exaggerate energy savings, if not done correctly. That being said, we have seen energy rates increase significantly the past few years, so any projects that ignored that were not accurately accounted for. We also highly encourage the total cost of electricity to be included in calculations, including supply, transmission, and all variable taxes and fees. Set fees, like a $25 fee for a commercial account can be ignored, because they will always be there. But a fee like a few pennies per kWh is actually quite important to include, as those really can scale with a commercial account that uses a lot of electricity.

What about peak Kw Charges vs KWh charges?

Peak kW charges are about how much energy your building uses at any one time. Electricity companies think about this for transmission lines, and your building is designed to use a certain max amount at any one time, typically below 100kW, between 100kW and 400kW, or above 400kW for the large users. Your service lines, as well as panels and interior wires, are all designed with this thought in mind. Your fees for electricity in terms of transmission are typically determined by this amount.

However, most of your charges for electricity are based on the amount of energy you use, which is measured in hours – or kilowatt hours (KWh). This unit is variable, and is the amount of actual electrons you are using. This is really impacted by energy efficiency projects and is easier to measure, typically, and calculate. This is how your supply of energy is measured, or often called delivery charges.

In a commercial energy efficiency project, you will both reduce the kWh and the kW. It is important to calculate both of these savings, but really kWh is the main driver in the net present value formula.

What About EV Car Charging Projects?

This same concept can be used to consider an EV Car Charging project.

First, what is the total cost of the investment to get the project installed, including permitting, engineering, the charger stand, as well as labor and small materials like wires and conduit. Let’s say this number is $5,000, which may feel high but is fairly standard for a commercial charger installation.

Next, we need to look at the revenue generated by the charger. If that is $1,000 per year – we would be looking at a simple 5 year payback, or 20% return on investment. However, you may want to discount for the future revenue streams, since $1,000 tomorrow is really worth less than $1,000 today. So that is how the Net Present value formula would work, and almost any spreadsheet would help you do this.

What if I plan to Sell My Building or Move My Business?

If you plan to sell your building, then you should consider anything that might add value to your sale price. If LED upgrades will add $10,000 to the sales price and cost $5,000 – then that would be a simple calculation for you and any energy savings before you sell would be gravy. Your realtor can help you navigate this and you should ask it as early as you can, especially if you are considering a few brokers. This can help you determine who you may want to work with to sell your building.

If you lease your space and are near your lease end, it can be difficult to do any project – even one with a very short ROI. However, you may want to talk to your landlord and they may be willing to help pay for a project near the end of your lease – to help you stay or even to help attract the next tenant. And if you are willing to project manage this – even better for the landlord.

How Do I Get Beyond a Spreadsheet on Net Present Value?

You really need to find a contractor that knows how to get this kind of work done for you to get beyond the spreadsheet. In fact, there are often rebates available to help drive down the up front cost of a project, which will only improve the payback or ROI for anything related to energy usage. So finding a contractor that not only can perform the work, but also help you get access to utility rebates, is important.

Fortunately for you, Verde can help you if your building is in Illinois, Wisconsin or even the Midwest. Fill out our free energy efficiency assessment form, and help us take your spreadsheet to the real world.

Featured Posts

Mar 15 2021

Energy Savings Formula

In 2002, I became a firefighter in the north suburbs of Chicago. I was young and idealistic - loving almost every part of the job. However, I had another secret passion - sustainability. In addition…

Continue Reading >

May 02 2019

Verde Energy Efficiency Experts 10 Most Sustainable Companies in Chicago

In our energy efficiency consulting firm, we constantly look for inspiration from local companies that lead and innovate in clean energy and sustainability. Not all companies have billion dollar budgets, but that doesn’t mean that…

Continue Reading >

Related Articles

May 13 2025

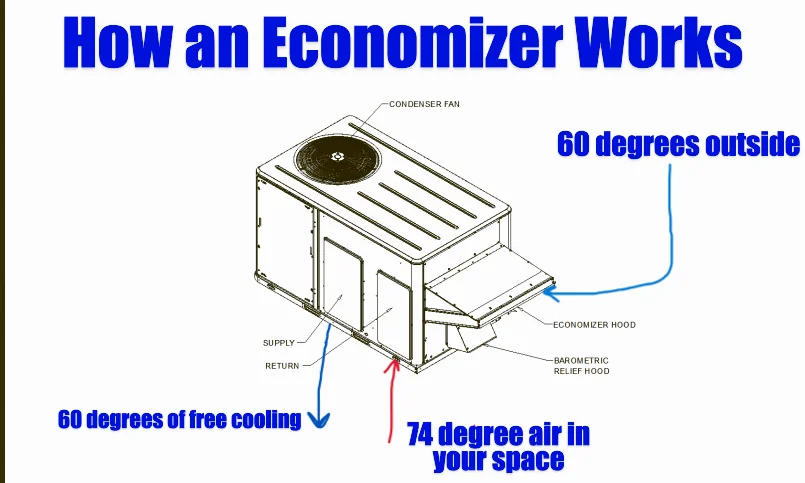

Advanced Rooftop Controls for Your Building

Growing up, my grandmother was an influential person in my life. She believed in me when I started my business – when everyone else thought I was nuts to leave my steady job at the…

Continue Reading >

Sep 03 2021

Inflation, Interest Rates and Sustainability

Back when I was a firefighter, I was incredibly lucky to study Economics and Environmental Policy at the University of Chicago in a graduate degree. In fact, much of my energy efficiency consulting business is…